|

| Rear ended, wondering how bad this damage is. (Page 1/2) |

|

windex42

|

JAN 26, 03:25 AM

|

|

Hi Everyone,

I'm hoping this isn't my final post, but we'll see what the insurance company does.

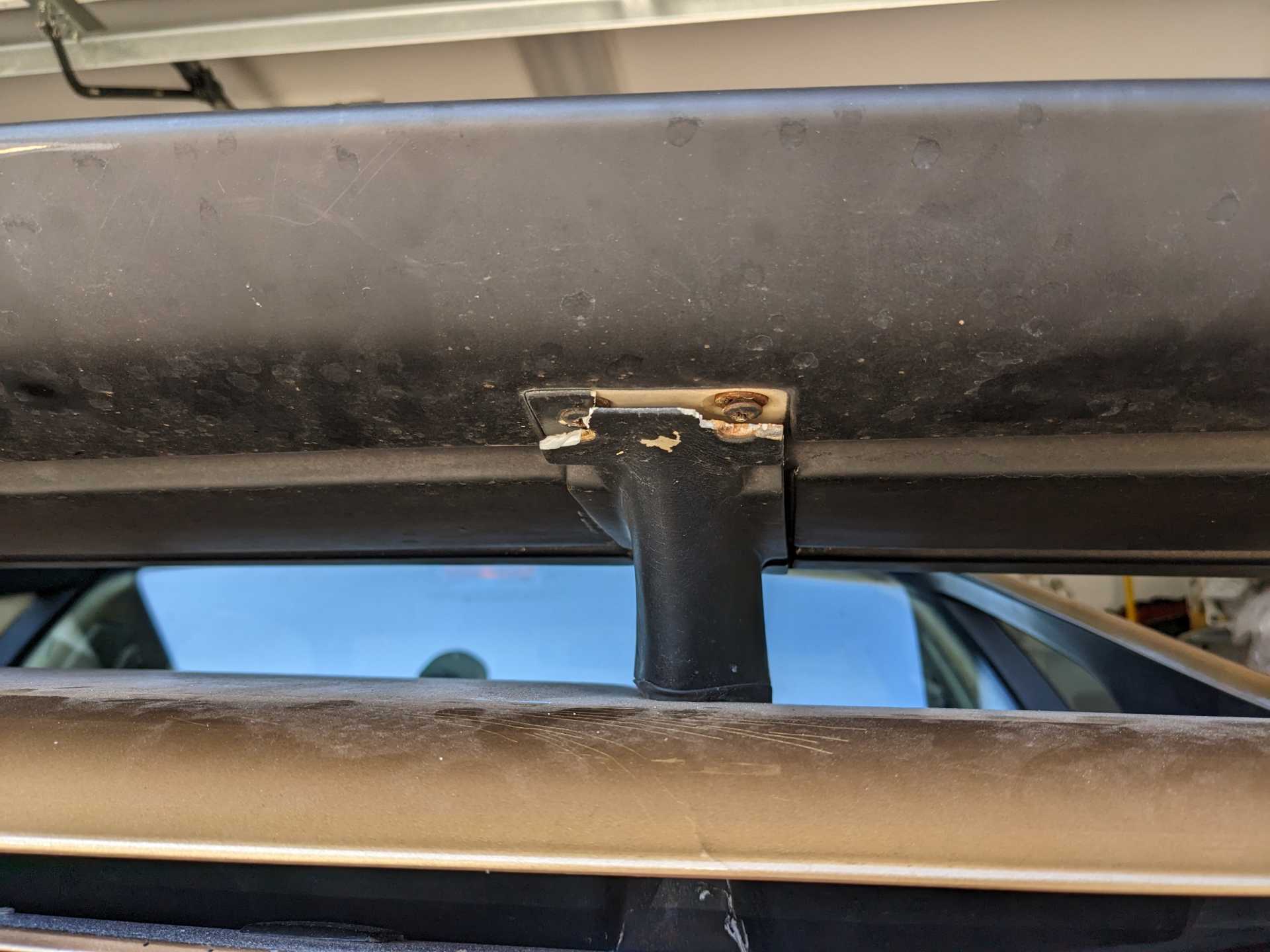

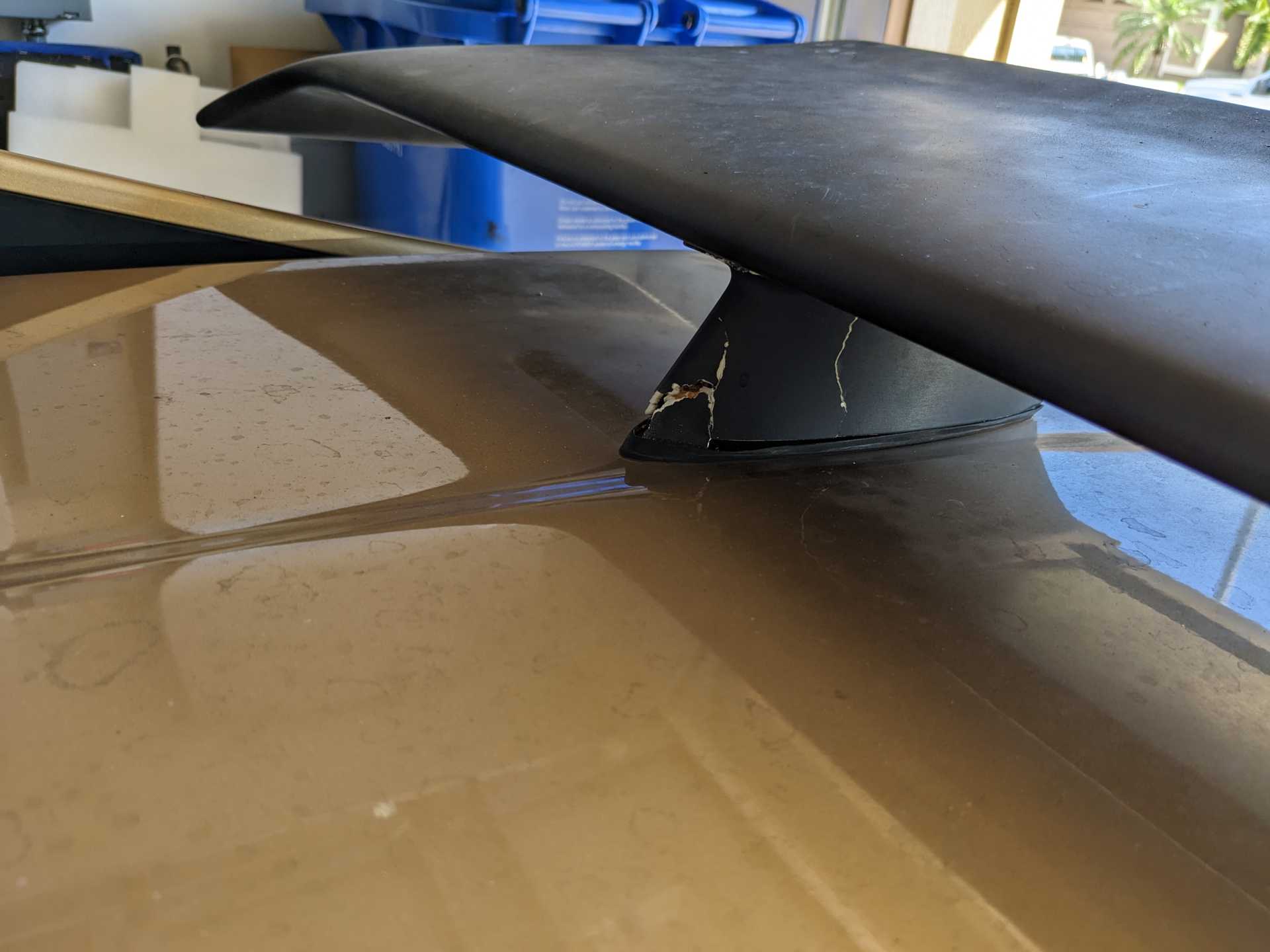

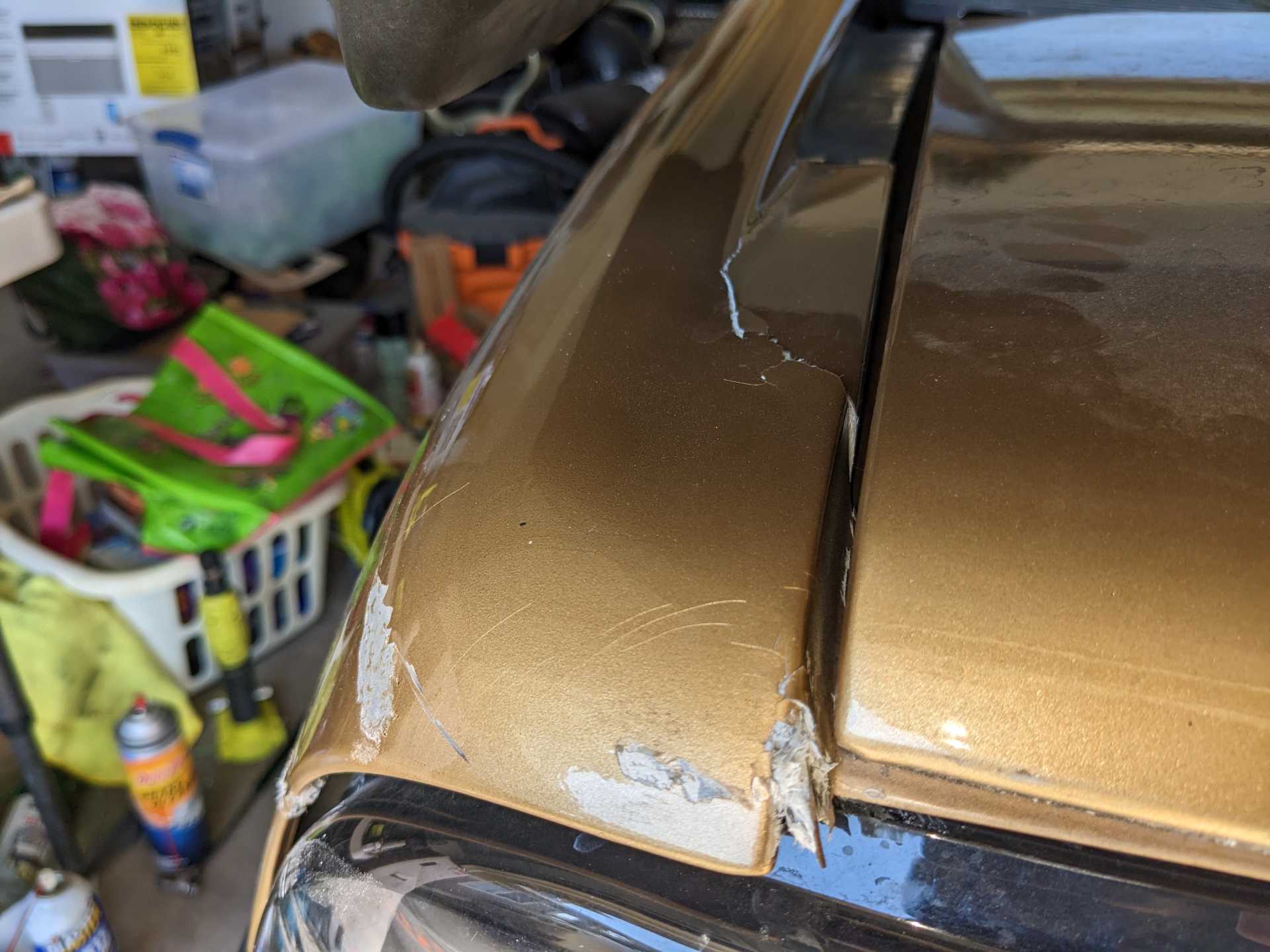

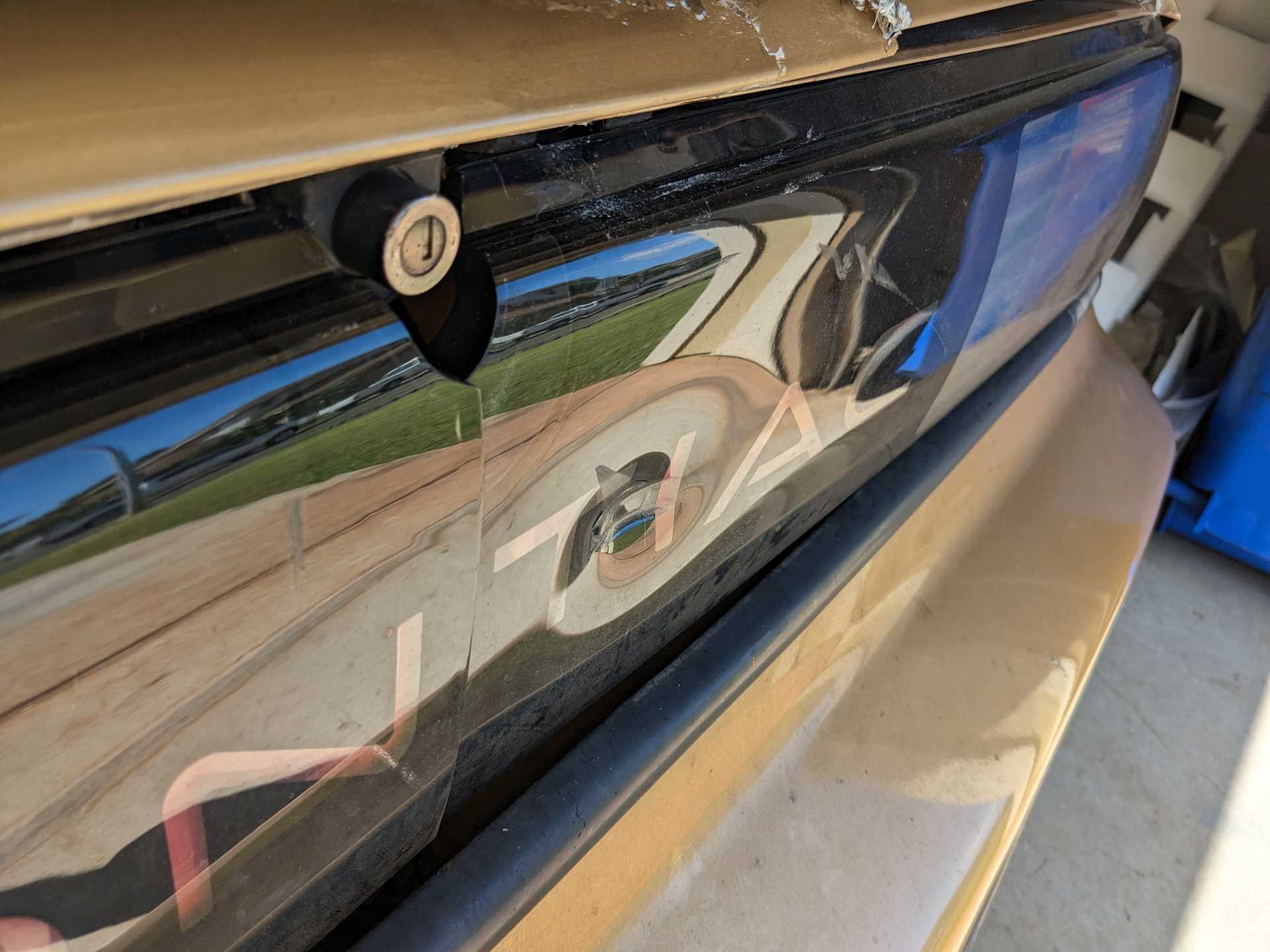

I was rear ended on the freeway by a lifted pickup truck.

The tail lights took the brunt of the damage, but the truck's tire caused some rubbing damage on the bumper. I'm surprised the thing didn't drive over me.

The other driver has insurance, so hopefully whatever happens is covered.

I'm wondering though,

does anyone have any idea how much a repair like this would cost?

Also, if totaled, I'm wondering what they might cut the check for.

I've got damage to the rear clip, deck lid, wing supports, bumper cover, grilles, tail light lenses, and trunk tub.

I couldn't say what damage would lie underneath though.

Here's some photos of the wreck, if you're into that sort of thing.

|

|

|

cam-a-lot

|

JAN 26, 08:33 AM

|

|

Unless you had an appraisal for a specific value for the car defined to your insurance company, they will most likely write it off- since the book value on the car is next to nothing.

Insurance company is only on the hook for up to X percent of the actual vehicle value , or agreed to appraised value when your policy renewed. So I hope you had an appraised value that the vehicle is insured for.

I don't see any frame damage, but can't tell until you pull the panels. Probably makes more sense to find replacement 86-87 panels that are already gold than trying to fix this.

Easily $3k in damage from what I can see, likely more if you want good tail lights, and this is assuming no frame damage

sorry about your luck..

|

|

|

fierofool

|

JAN 26, 08:48 AM

|

|

| quote | Originally posted by cam-a-lot:

Unless you had an appraisal for a specific value for the car defined to your insurance company, they will most likely write it off- since the book value on the car is next to nothing.

Insurance company is only on the hook for up to X percent of the actual vehicle value , or agreed to appraised value when your policy renewed. So I hope you had an appraised value that the vehicle is insured for.

....................................(snip). |

|

Agreed value still may not get more than a few bucks. One of our guys down here was rearended in his Formula. The car has less than 70K miles. Agreed value on the car was $16,000. They are offering him $6,000. The car is repairable and one of our members who owns a paint and body shop is repairing it. At least as bad as windex42's car. Same thing. Lifted F-150. Hit and run.

|

|

|

Awalker W02

|

JAN 26, 11:48 AM

|

|

In the event of a total loss Insurance companies are subject to pay ACV + title fees and in most states applicable sales tax. Each state has different standards to declare a total loss. For example. Missouri is 80% of value while Arkansas and Iowa are 70%. Arkansas has a clause where if the vehicle is over 10 years old then the Total loss threshold changes to TLF. Which is the ACV (actual cash value) less the salvage value of the vehicle. It the car reaches that amount then it has to be deemed a tl. Now if a car is below the threshold most have structural total loss clauses that can contain a number of total loss opportunities.

Now that being said ACV is a moving number. As long as you can prove your case it can change. In a first party dispute most ISO’s/ insurance standards have a clause in the policy stating that each party can hire an appraiser and then both valuations are reviewed by a mediator. that generally won’t go that far with your adjuster but some research would be needed on your end to settle an ACV dispute. Documenting comparable vehicles. Try to find the same year make, model and sub model. Options are key in our collectors world. Mileage and minor adjustments can be made. In our world right now there are not many certified sales to prove current values. Most rely on dealer quotes. You can always ask the adjuster to see the comps.

That’s my day job so if you have any questions just ask

|

|

|

cvxjet

|

JAN 26, 11:58 AM

|

|

I had a fool turn onto my street at a high rate of speed- not realizing there was a big dip (Not me) so he lost control, missed my new '99 Firebird but smack the back of my Fiero- then he took off.

The insurance appraiser stated (Basically) "Total loss- frame is bent" I had my friend who owns a body shop inspect it and concurred with my opinion; Trunk bottom bent- but frame absolutely straight.

Luckily, I was good friends with my insurance agent, so she sent another inspector and then cut me a check for $450....I used approx' $100 to get the trunk straightened and pocketed the rest.

You are definitely going to have a lot of (Plastic) bodywork repair- and the trunk upper edge needs to be straightened- the taillights will be the hardest (Most expensive) thing to replace- possibly go to the fiberglass cover with round taillights (Side note- why didn't someone build a FG tail cover with twin slot taillights like all the old PONTIACS had?)

|

|

|

windex42

|

JAN 26, 01:24 PM

|

|

Hey everyone,

Thanks for your input.

That gives me a better idea of what to expect.

A repair of $3000 would hopefully be under the actual value of the car. It would be nice to get her fixed, and back on the road.

The Tail light situation does upset me a bit. I was pretty happy that I got a set of Keith Goodyear's reproduction lenses, now those are no longer available, and I don't think I'd settle for less.

Parts would be tough to ship to Hawaii, but I'm sure the body shops deal with it frequently. I would hate to see shipping costs on sending a rear clip from the mainland.

It's nice to know someone got $6000 I have more than that into the car, but insurance won't care. With today's rising car prices though, I do wonder what a payout would be like for mine.

Regarding comps, I hear they usually look for past local sales. That's great for a Camry in Kansas, but not so good for a Fiero in Hawaii. They really don't sell here, they almost don't even exist here.

I was looking at cars.com to see what they're "selling" for.

Please let me know if there's a better resource for this.

It's interesting to see some asking prices around 14K, but probably unreasonable to think insurance would come anywhere close, if totaled.

I'll surely post any info I get through this process.

-==-

Nick

|

|

|

TheDigitalAlchemist

|

JAN 26, 02:33 PM

|

|

Nothing to add but to say that I'm glad you are ok and I hope the car can be repaired. If its not, don't give up on Fieros - a drunk dummy took out mine once and I ended up in a "new" one. Maybe you can buy it back and part it out (or use it as a parts car) - I don't know if you have the room, but it's an option...

GOOD LUCK!

|

|

|

theogre

|

JAN 27, 01:14 AM

|

|

⚠️ Warning: Your car will very likely be "Totaled" and for most reasons said above.

If you sign anything with this...

1. The car is now owned by the I-co.

2. If you Buy the Car Back then often will have a Salvage Title and Can Not just fix and drive in many places.

Because Many US States Requires a "Special Inspection" after Restoring a Salvage/Total vehicle and often involving State Police and/or need a lot of Receipts and other Doc's. Worse if have 87 and up vehicles that had VIN labels on nearly everything.

These inspections go way beyond standard Safety/Emission Inspection even in strictest states.

3. Expect if selling later, Carfax et al can flag the Total and car has very little value even if was repaired 100% correct. (Some states and/or some I-co's do not share data of any type w/ Carfax and related.)------------------

Dr. Ian Malcolm: Yeah, but your scientists were so preoccupied with whether or not they could, they didn't stop to think if they should.

(Jurassic Park)

The Ogre's Fiero Cave

|

|

|

Awalker W02

|

JAN 27, 12:20 PM

|

|

|

You really need to check state guidelines if it come to retaining the total loss if you get to that point. Iowa does not require on on retention now they do provide you with a seller disclosure to disclose the total loss to the next purchaser. In Missouri anything 7 years or older gets exempt from a branded title if you retain. May states have clauses like this.

|

|

|

Phirewire

|

FEB 06, 04:51 PM

|

|

| quote | Originally posted by Awalker W02:

You really need to check state guidelines if it come to retaining the total loss if you get to that point. Iowa does not require on on retention now they do provide you with a seller disclosure to disclose the total loss to the next purchaser. In Missouri anything 7 years or older gets exempt from a branded title if you retain. May states have clauses like this. |

|

100% to this and his previous statement, also my field. Only other thing to keep in mind would be what insurance you have and what the other parties insurance is. Ultimately the adjuster is going to work within the policy language and state regulations. They won't offer or bend in any area unless given documentation to lead them otherwise. Most likely the car would be a total loss strictly on part availability unless otherwise worked out with you.

|

|

|

|